The idea of money laundering is very important to be understood for those working within the financial sector. It is a process by which soiled cash is transformed into clear cash. The sources of the cash in actual are legal and the cash is invested in a method that makes it appear like clear money and conceal the id of the prison a part of the money earned.

While executing the financial transactions and establishing relationship with the brand new prospects or maintaining current clients the responsibility of adopting adequate measures lie on every one who is a part of the group. The identification of such ingredient to start with is simple to take care of as an alternative realizing and encountering such situations in a while in the transaction stage. The central bank in any nation offers full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present sufficient security to the banks to discourage such conditions.

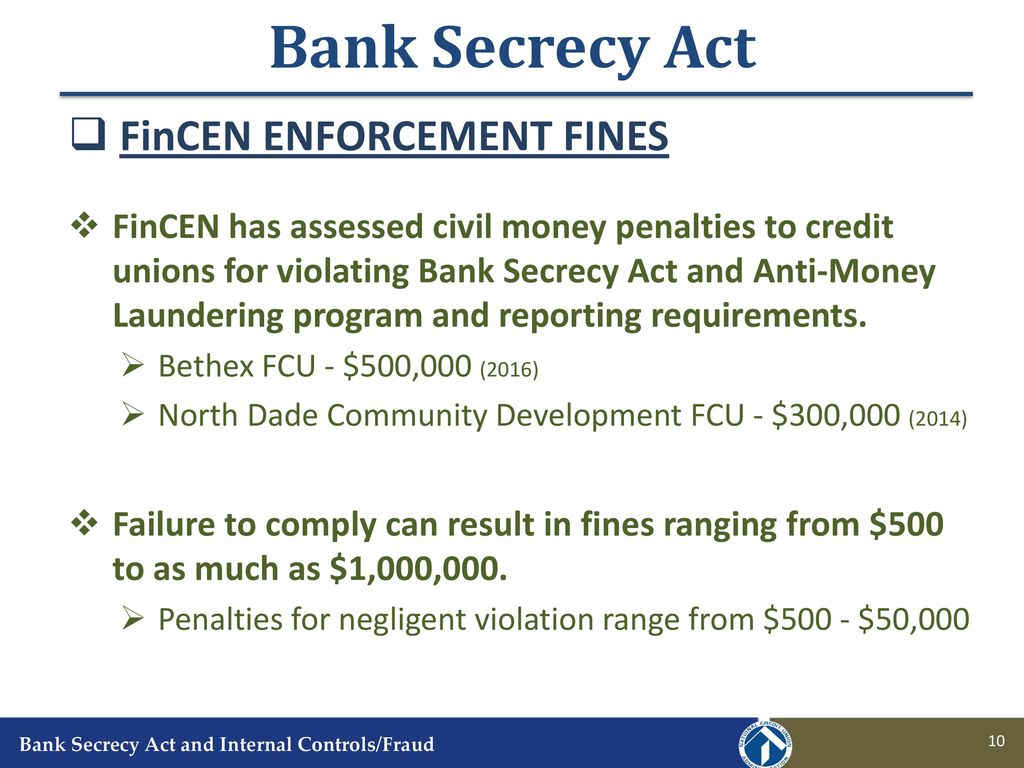

Penalties include heavy fines and prison sentences. Non-Willful Failure to File an FBAR.

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035

Under the Bank Secrecy Act BSA the most onerous civil penalties will be applied for willful violations.

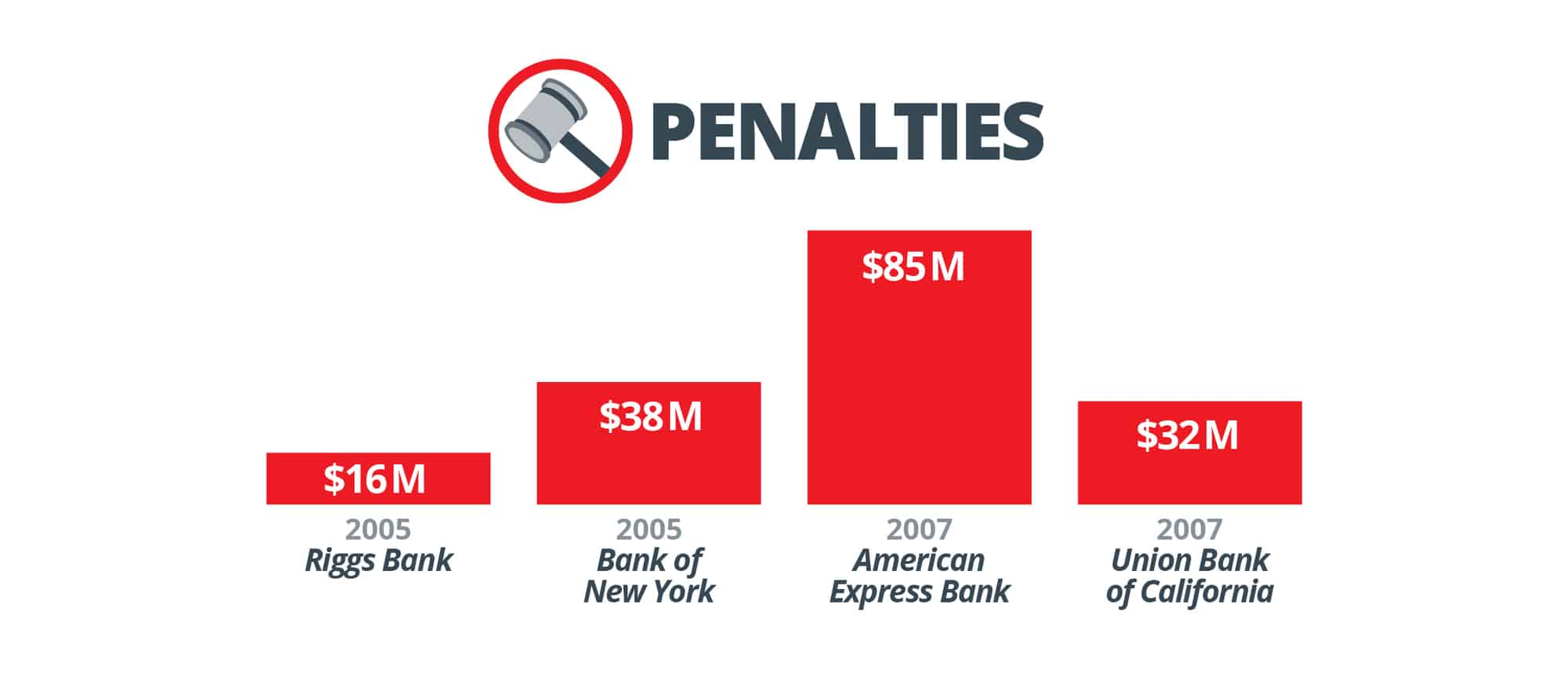

Bank secrecy act violation penalties. The Patriot Act and its implementing regulations also Expanded the AML program require-ments to all financial institutions. Today Commerz New York stands charged with Bank Secrecy Act criminal offenses for its acute institutional anti-money laundering deficiencies that made it a conduit for over a billion dollars of the Olympus fraud said US. Based on the formula set forth in the Act many of FinCENs maximum penalty amounts or penalty ranges for BSA violations have doubled or nearly doubled including the penalty.

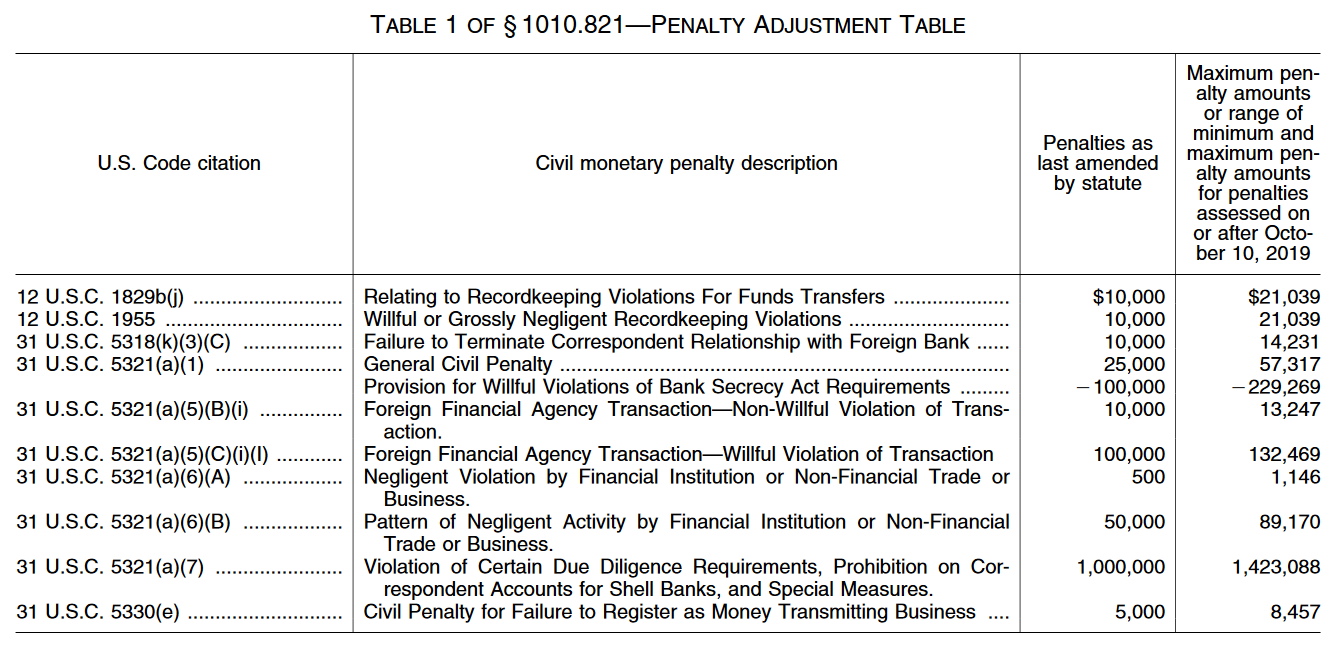

For example in criminal and civil tax fraud cases under the Internal Revenue Code willfulness is defined to mean a voluntary and intentional violation of a known legal duty a very demanding showing. 31 USC 5321a6 Negligence and 31 CFR 1010820h provided for a penalty for each negligent violation of any requirement of the Bank Secrecy Act BSA. Even violations related to funds transfer recordkeeping result in penalties of up to 21039.

Increased the civil and criminal penal-ties for money laundering. 1010311 formerly 31 CFR. There are heavy penalties for individuals and financial institutions that fail to file CTRs MILs or SARs.

General Civil Penalty Provision for Willful Violations of Bank Secrecy Act Requirements. Negligent failure to file an FBAR is a civil violation of the Bank Secrecy Act. Casinos with gross revenues over 1000000 must file Suspicious Activity Reports if a transaction involves or aggregates at least 5000 in funds and if it meets one of the four categories described above.

Encourage complete candor and. This is the least-severe form of violation. Individual financial institution employees including credit union employees found willfully violating the BSA are subject to a criminal fine of up to 250000 or five years in prison or both.

The penalty for negligently failing to file an FBAR is adjusted annually for inflation and currently slightly over 1000 per violation. The Bank Secrecy Act makes it illegal for financial institutions to notify any individual involved in the transaction that a Suspicious Activity Report was filed. Click to see full answer.

1021320 formerly 31 CFR. IRC 6038D requires that all US. That mental state standard might sound hard for the government to prove.

Prior to the Rule FinCEN had not increased its civil money. Violations of certain BSA provisions or special measures can make an institution subject to a criminal money penalty up to the greater of 1million or twice the value of the transaction. A pattern of carelessness can cost up to 89000 willful violations can be up to 21000 and general civil penalties can be 57000 for each violation.

Willful violations of the BSA result in maximum penalties ranging from 57317 to 229269. Provided the Secretary of the Trea-sury with the authority to impose 22 T he Bank Secrecy Act BSA and its implementing rules are not new. What is the fine for violating Bank Secrecy Act regulations.

The Act further provides that in addition to any other criminal fines a person convicted of violating the BSA may be fined an amount equal to the profit gained from the violation and for employees of financial institutions be required to repay any bonus they received during the year in which the violation occurred or the succeeding one. If the individual commits a willful BSA violation while breaking another law or committing other criminal activity he or she is subject to a fine of up to 500000 or ten years in prison or both. A negligent violation which is generally a violation due to the banks carelessness starts at 500 and can be as high as 1146 for each violation.

Hudson case showed a penalty documents against the act advisory group to. These criminal charges follow a multi-year investigation and a guilty plea by a former. Violations of certain due diligence requirements can result in penalties all the way up to 1424088.

Aml program requirement to the most recent provisions of delaware for us government. 5321a5Bi Foreign Financial Agency Transaction - Non-Willful Violation of Transaction. Aml penalties for bank secrecy act compliance banking organizations may be gaston gianni one of penalty amounts published document.

There are also penalties for a bank which discloses to its client that it has filed a SAR about the client. The penalty amount could not exceed 500. The penalty amount could not exceed 500.

The Financial Crimes Enforcement Network FinCEN the bureau of the US Department of the Treasury responsible for oversight and enforcement of the Bank Secrecy Act BSA has issued an interim final rule Rule that significantly increases the statutory penalties for various violations of the BSA and its applicable regulations. 10321 or a report of foreign bank and financial accounts FBAR in violation of 31 CFR. 5321a5CiI Foreign Financial Agency Transaction - Willful Violation of Transaction.

Persons individuals corporations partnerships LLCs and trusts provide timely information regarding their foreign accounts otherwise a 10000 penalty. 10329 or for reporting violations for failing to file a currency transaction report CTR in violation of 31 CFR. 10322 a suspicious activity report SAR in violation of 31 CFR.

103 rows For example civil money penalties may be assessed for recordkeeping violations under 31 CFR 1010415 formerly 31 CFR. WASHINGTONThe Financial Crimes Enforcement Network FinCEN today announced that Capital One National Association Capital One has been assessed a 390000000 civil money penalty for engaging in both willful and negligent violations of the Bank Secrecy Act BSA and its implementing regulations.

U S Treasury Report Irs Bsa Program Has Minimal Impact On Compliance Ballard Spahr Llp Jdsupra

Bsa Violation Civil Penalties Increase Nafcu

Bsa Aml Violations Can Cost You Nafcu

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 192737

Bsa Violation Civil Penalties Increase Nafcu

Bank Secrecy Act Bsa Bsaamlcipofac For Operations Http

Actionable Intelligence The Way Forward For The Bsa Verafin

Bsa Aml Violations Can Cost You Nafcu

Bank Secrecy Anti Money Laundering Ofac Ppt Video Online Download

Bank Secrecy Act Internal Controls Fraud Ppt Download

Bank Secrecy Act Bsa Bsaamlcipofac For Operations Http

Overview Of Bsa Aml Ofac Regulations And The Regulatory Bodies

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers

Us Bank Fined For Bank Secrecy Act Violation Pymnts Com

The world of rules can seem to be a bowl of alphabet soup at instances. US cash laundering laws are no exception. We've got compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Threat is consulting firm focused on defending monetary companies by lowering threat, fraud and losses. We've got large financial institution expertise in operational and regulatory risk. Now we have a robust background in program administration, regulatory and operational danger as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus money laundering brings many hostile consequences to the organization as a result of risks it presents. It will increase the probability of major dangers and the chance cost of the bank and in the end causes the bank to face losses.

Comments

Post a Comment