The concept of cash laundering is very important to be understood for these working within the monetary sector. It's a process by which dirty money is converted into clear cash. The sources of the cash in precise are prison and the money is invested in a way that makes it look like clean money and hide the id of the prison a part of the money earned.

While executing the monetary transactions and establishing relationship with the new customers or sustaining present customers the responsibility of adopting satisfactory measures lie on every one who is a part of the group. The identification of such ingredient in the beginning is simple to take care of as an alternative realizing and encountering such situations in a while within the transaction stage. The central financial institution in any nation gives complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide enough safety to the banks to discourage such conditions.

Cloudera from SAS that permit virtually instantaneous reactions to detected anomalies are all expected to be part of the Fifth Money Laundering. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks.

What Is Customer Risk Assessment In Aml Kyc How To Perform Customer Risk Assessment In Bank Fi Youtube

Unit 1 Risk Assessment for Money Laundering This unit describes the need for combating AML risks and other financial crimes.

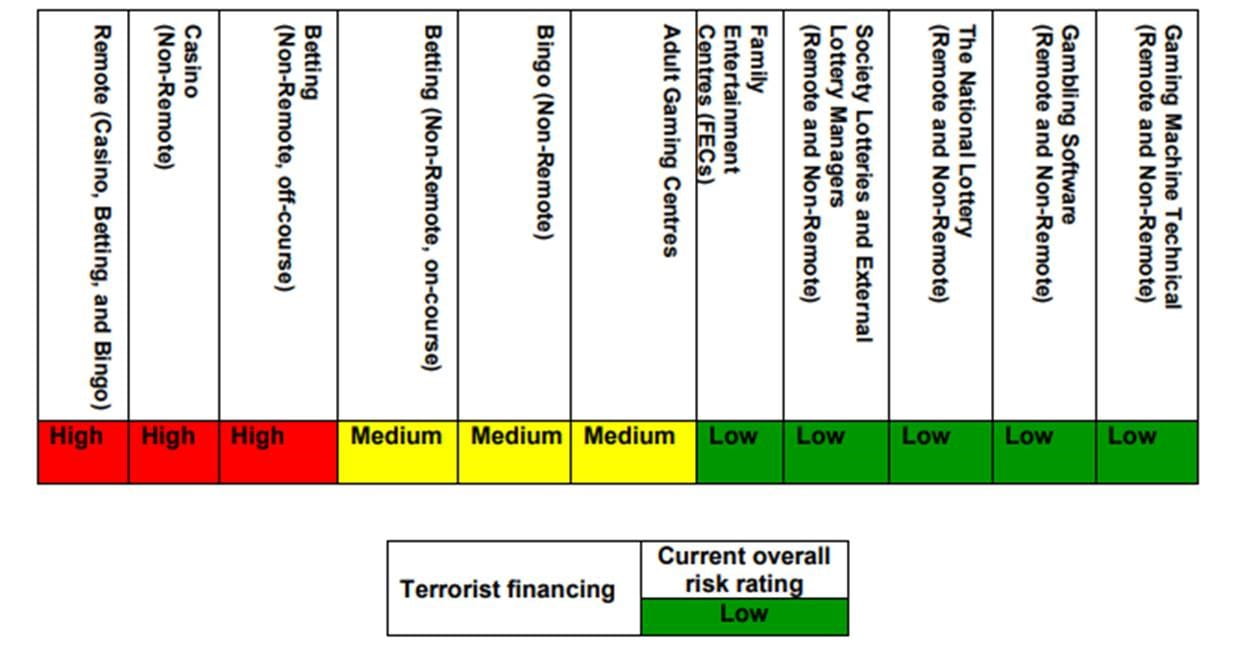

Money laundering risk categorisation. 147 Risk can be defined as the likelihood of an event and its consequences. Customers in these categories can pose an inherently high risk for money laundering. There clearly is not one single methodology to apply to these risk categories and the application of these risk categories is intended to provide a strategy for managing potential money laundering risks associated with potentially high risk.

Businesses regulated by the Money Laundering Regulations must assess the risk that they could be used for money laundering including terrorist financing. You can decide which areas of. Customers seeking to carry out a new business activity andor commercial activity in cash-intensive sectors with a profile completely unrelated to their respective profession.

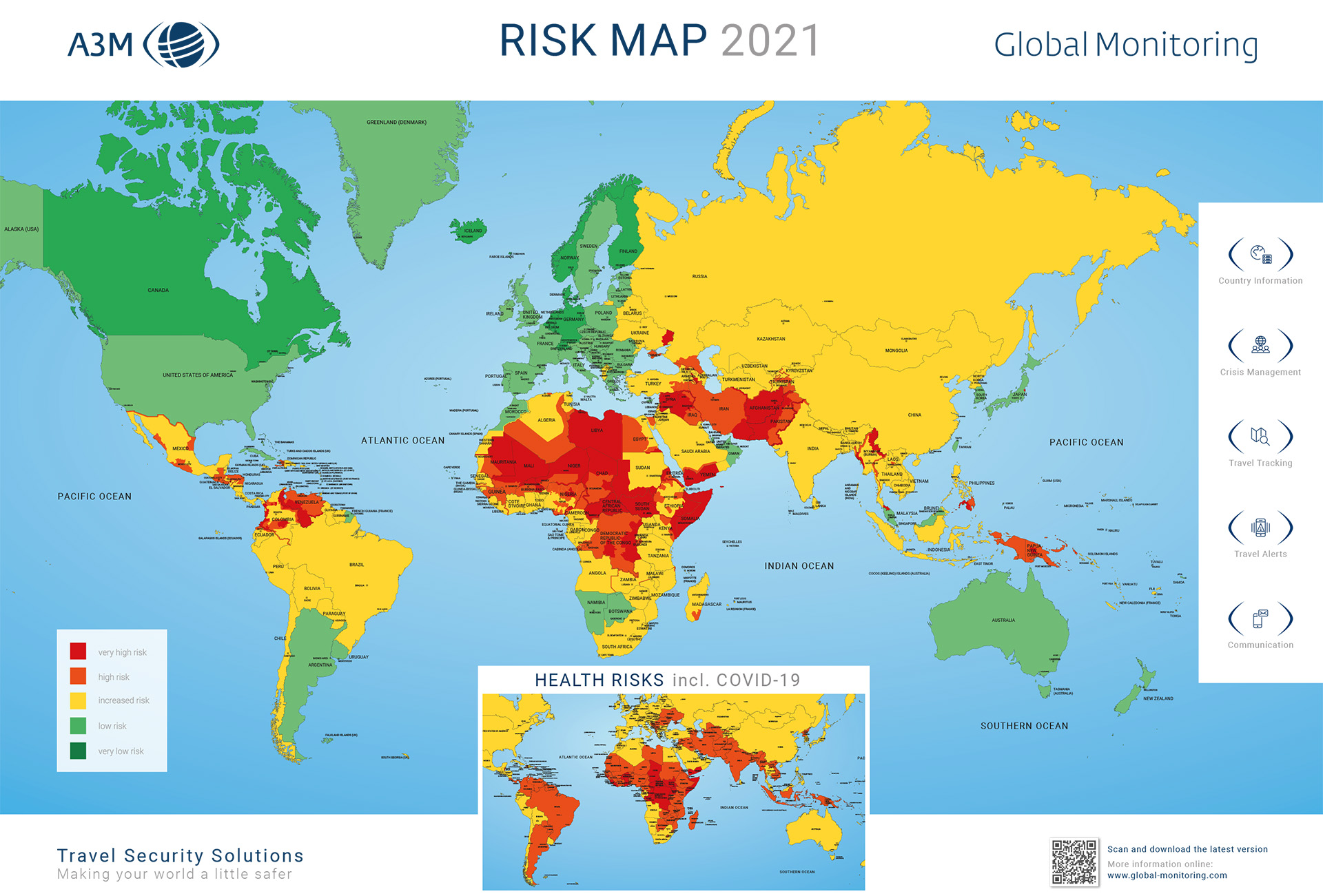

The premise behind the effort is clear. The first is the idea of geographic risk. First Recommendation 12 requires a reporting entity to have òappropriate ó risk management.

More detail on the enhanced due diligence required in specific high-risk cases such as Politically Exposed Persons as well as the incorporation of cryptocurrencies and Blockchain into ML regulation stringent controls on pre-paidcards and further steps towards central registries based on big data analytics eg. On 26 April 2021 the Hong Kong Monetary Authority HKMA published its key observations and good practices from a thematic review on the use of external information and data. In the context of money launderingterrorist financing MLTF risk means.

The risks a bank faces during the money laundering cycle are classified into two categories criminal environment and product and service risk. Understanding risk within the Recommendation 12 context is important for two reasons. One of the key requirements of the FATF Recommendations is for countries to identify assess and understand the money laundering ML and terrorist financing TF risks that they are exposed to.

The nature and extent of due diligence will depend on the risk perceived by the Company. Threats and vulnerabilities presented by MLTF that put at risk the. Real Case Decentralized Finance DeFi has become more and more popular in the past few months.

Hong Kong Monetary Authority delivers four key messages from thematic review over use of external information in management of money laundering and terrorist financing risks. Advance cash payment of large amounts for future transactions or fees. The UKs National Risk Assessment for money laundering said that digital currencies pose the lowest risk for money laundering alongside cash financial services banks and accountants.

C For the purpose of risk categorisation individuals other than High Net Worth and entities whose identities and sources of wealth can be easily identified and transactions in whose accounts by and large conform to the known profile may be categorised as low risk. At the national level. Accurate risk assessment is central to the risk-based approach there are two distinct categories of risk that inform financial institutions compliance efforts.

A money laundering risk assessment is an analytical process applied to a business to measure the likelihood or probability that the business will unwittingly engage in money laundering. 3 146 Residual risk is the level of risk that remains after the implementation of mitigation measures and controls. Financial institutions must be able to respond to threats on a contextual basis to balance efficiency and cost needs with compliance obligations.

DeFi Money Laundering Scam Risks for Users. Risk of potential money laundering is discretionary with each institution. Lack of limitation of cash payments of fees.

The customer profile contains information relating to customers identity socialfinancial status nature of business activity information about his clients business and their location etc. Such risk categorisation is provided in Annexure I. The Project on developing a risk-based methodology for an automatic anti-money launderingcounter terrorist financing risk categorisation for supervised entities in Portugal is one of the four projects implemented under the overall CoEEU TSI programme.

The vulnerability to money laundering threats that countries face at a national level. According to the statistics by Q1 21 the overall monthly trade volume has almost tripled compared to December 2020 25 billion.

Classification Of Highetened Risk Individuals And Entities

Eu Policy On High Risk Third Countries European Commission

Geography Risks For Anti Money Laundering Compliance Aml Software

Central Bank Governance And The Role Of Nonfinancial Risk Management In Imf Working Papers Volume 2016 Issue 034 2016

Pci Compliance Infographic For Merchant Acquirers Controlscan Compliance Business Risk Financial Regulation

Effective Money Laundering Aml Risk Assessment In 2021 Financial Crime Academy

Money Laundering And Terrorist Financing Risk Assessment 2020 Lexology

Management Business Anti Money Laundering Software Know Your Customer Computer Software Png 681x636px Management Antimoney Laundering

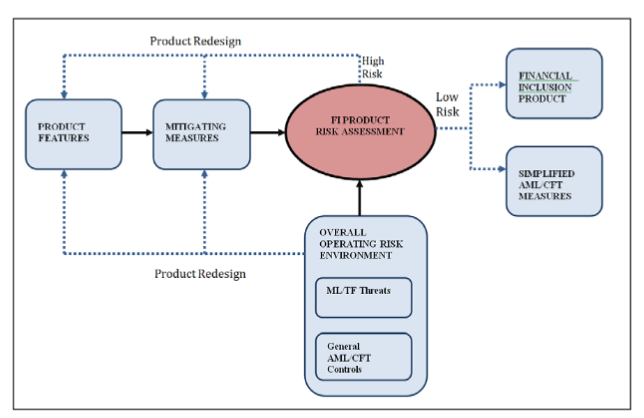

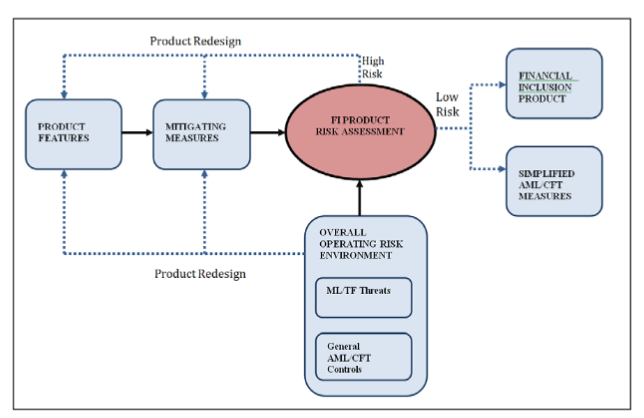

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation

Risk Map A3m Global Monitoring

Guidance On Money Laundering Terror Financing Risk Assessment By Nbfcs

Annex 6 Examples Of Risk Assessment Tools Fatf Guidance Anti Money Laundering And Terrorist Financing Measures And Financial Inclusion With A Supplement On Customer Due Diligence Updated November 2017 Better Regulation

Evaluating The Risk Based Approach Acams Today

Eu Policy On High Risk Third Countries European Commission

The world of regulations can look like a bowl of alphabet soup at occasions. US money laundering laws are no exception. We now have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Danger is consulting agency centered on protecting monetary services by reducing danger, fraud and losses. We've large financial institution expertise in operational and regulatory danger. We now have a robust background in program management, regulatory and operational risk as well as Lean Six Sigma and Enterprise Course of Outsourcing.

Thus cash laundering brings many opposed penalties to the group because of the risks it presents. It will increase the probability of main risks and the opportunity value of the financial institution and finally causes the financial institution to face losses.

Comments

Post a Comment